The Internal Revenue Service has released updated guidance on IRS refund timelines for February, giving millions of Americans a clearer idea of when their tax payments may arrive. As the 2026 tax season progresses, refund timing remains a top concern for early filers across the United States.

February IRS Refund Schedule Explained

Most taxpayers who filed electronically and chose direct deposit can expect their refunds within the standard 21-day processing window. For many early filers, this places expected refund deposits throughout February, depending on the filing date and return accuracy.

Returns submitted in late January or early February are generally processed first, provided there are no errors or additional review requirements. Refunds are issued on a rolling basis rather than all at once.

Who May Receive Refunds Later in February

Some taxpayers may see their refunds arrive later than expected. Returns that include refundable credits, such as income-based tax credits, often undergo additional verification. These checks can extend processing time even when returns are filed correctly.

Paper-filed returns and amended returns usually take longer, as they require manual handling. Taxpayers who selected mailed checks instead of direct deposit should also expect extra time for delivery.

What Affects IRS Refund Timing

Several factors influence when a refund is issued, including filing method, accuracy of information, claimed credits, and identity verification. Even after the IRS sends a refund, individual bank processing times can affect when funds appear in an account.

A refund marked as “processing” simply means the return is still under review and does not necessarily indicate a problem.

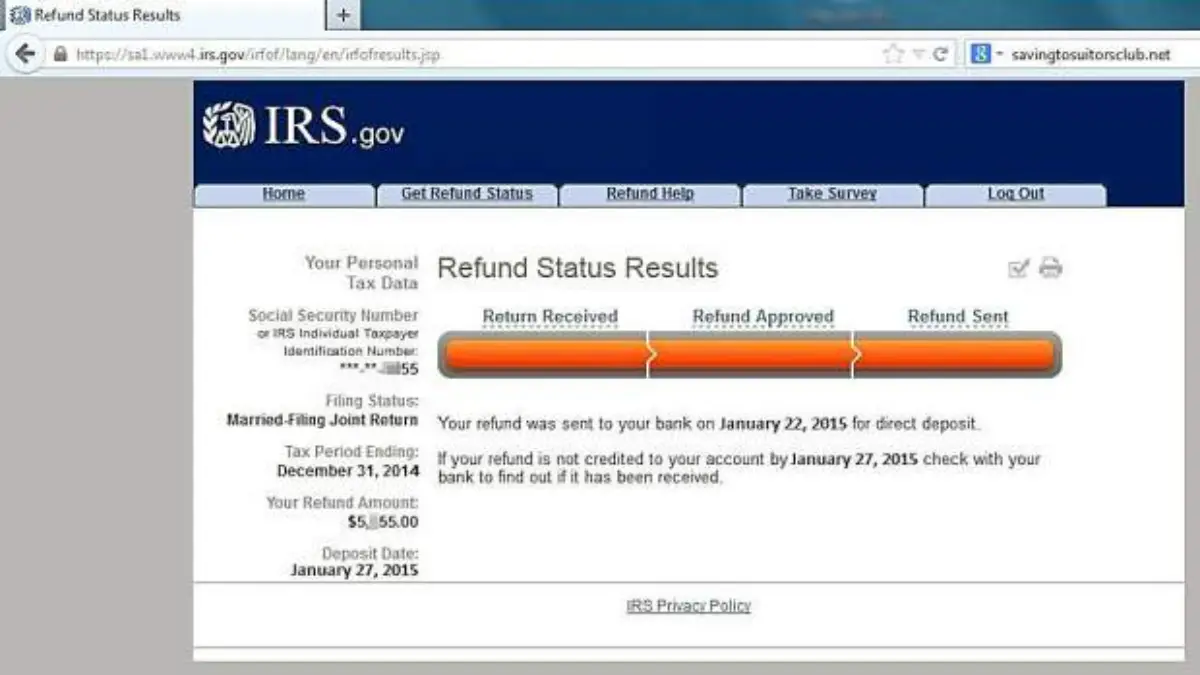

How to Track Your February IRS Refund

Taxpayers can monitor their refund status using official IRS tracking tools. Status updates are typically refreshed once per day, so frequent checking will not speed up processing. Once a refund is approved, the status will update before the payment is issued.

What Taxpayers Should Do Now

Experts recommend avoiding duplicate filings or unnecessary amendments, as these actions can cause delays. Ensuring that personal details, income information, and banking details are accurate helps prevent processing issues.

If the IRS requests additional information, responding promptly can help keep refunds on schedule.

February Refund Outlook for Taxpayers

The IRS expects refund processing to continue steadily throughout February. While some taxpayers may experience delays due to additional reviews, most eligible filers should receive their refunds within the expected timeframe.