As the 2026 tax filing season moves forward, millions of taxpayers are waiting for their federal tax refunds. The IRS has begun processing returns, and many early filers are already receiving direct deposits. Understanding the refund schedule can help taxpayers estimate when their payment will arrive.

Here’s a clear breakdown of the IRS refund timeline and estimated payment dates for February 2026.

When the IRS Started Processing Refunds

The Internal Revenue Service began accepting federal tax returns at the start of the 2026 filing season. Taxpayers who filed electronically and chose direct deposit are typically first to receive refunds.

Most refunds are issued within 7 to 21 days after the IRS accepts the return, assuming there are no errors or additional review requirements.

Estimated IRS Refund Dates for February 2026

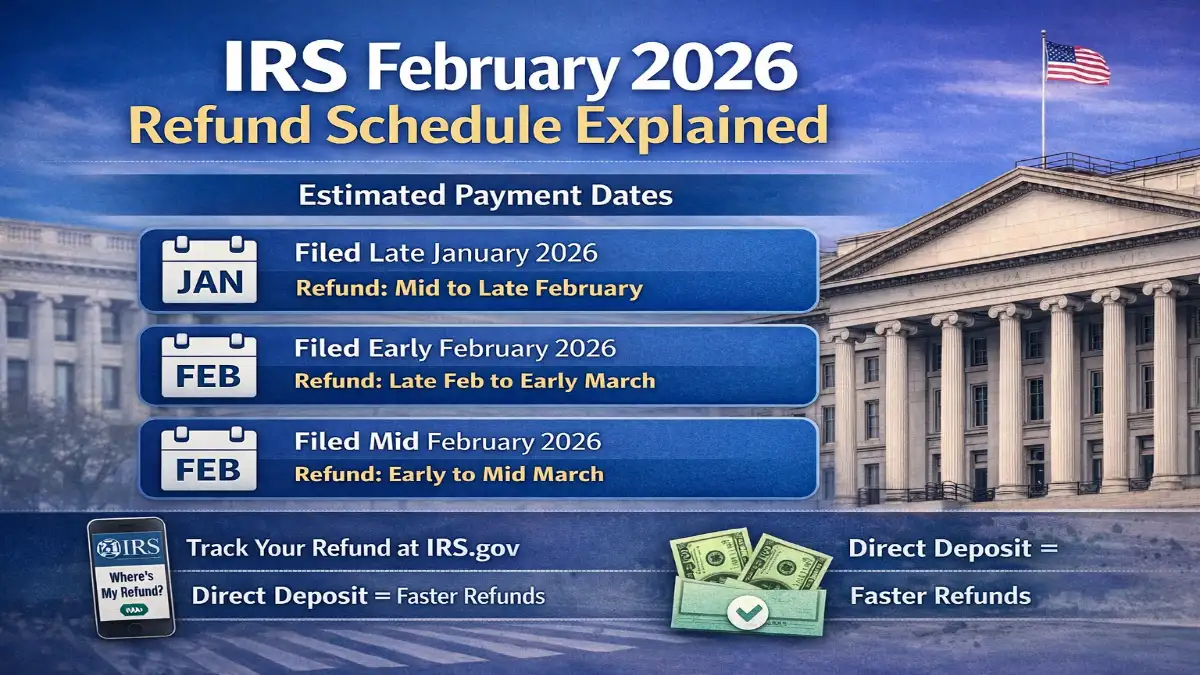

Although exact deposit dates vary by individual return, the following general timeline applies:

Returns accepted in late January 2026

Estimated refund arrival: Mid-February to late February 2026

Returns accepted in early February 2026

Estimated refund arrival: Late February to early March 2026

Returns accepted in mid-February 2026

Estimated refund arrival: Early March to mid-March 2026

Paper-filed returns

Estimated refund arrival: Four to eight weeks or longer

Direct deposit remains the fastest way to receive refunds.

Factors That Affect Refund Timing

Several factors can impact how quickly your refund arrives:

- Filing method (electronic or paper)

- Accuracy of information provided

- Claims involving tax credits

- Identity verification requirements

- IRS processing volume during peak season

Errors or incomplete information may cause delays.

Direct Deposit vs Paper Check

Taxpayers who select direct deposit usually receive refunds faster than those waiting for paper checks.

Direct deposit transfers funds electronically to your bank account, while paper checks require mailing time, which can add several days or weeks.

How to Track Your Refund Status

Taxpayers can track their refund status using the official IRS tool called “Where’s My Refund?” on IRS.gov.

To check your status, you need:

- Social Security number or ITIN

- Filing status

- Exact refund amount

The tool provides updates when your return is received, approved, and sent.

Tips to Receive Your Refund Faster

To avoid delays and speed up your refund:

- File electronically

- Choose direct deposit

- Double-check your tax return information

- Submit your return early

These steps help ensure faster processing.

Final Thoughts

The IRS refund schedule for February 2026 follows the standard processing timeline, with most electronic filers receiving their refunds within three weeks. Taxpayers who file early and choose direct deposit are likely to receive their payments sooner.